Insights on Value Capture and Growth Readiness

How industrial owners build resilience, attract capital, and capture the next layer of value before they sell.

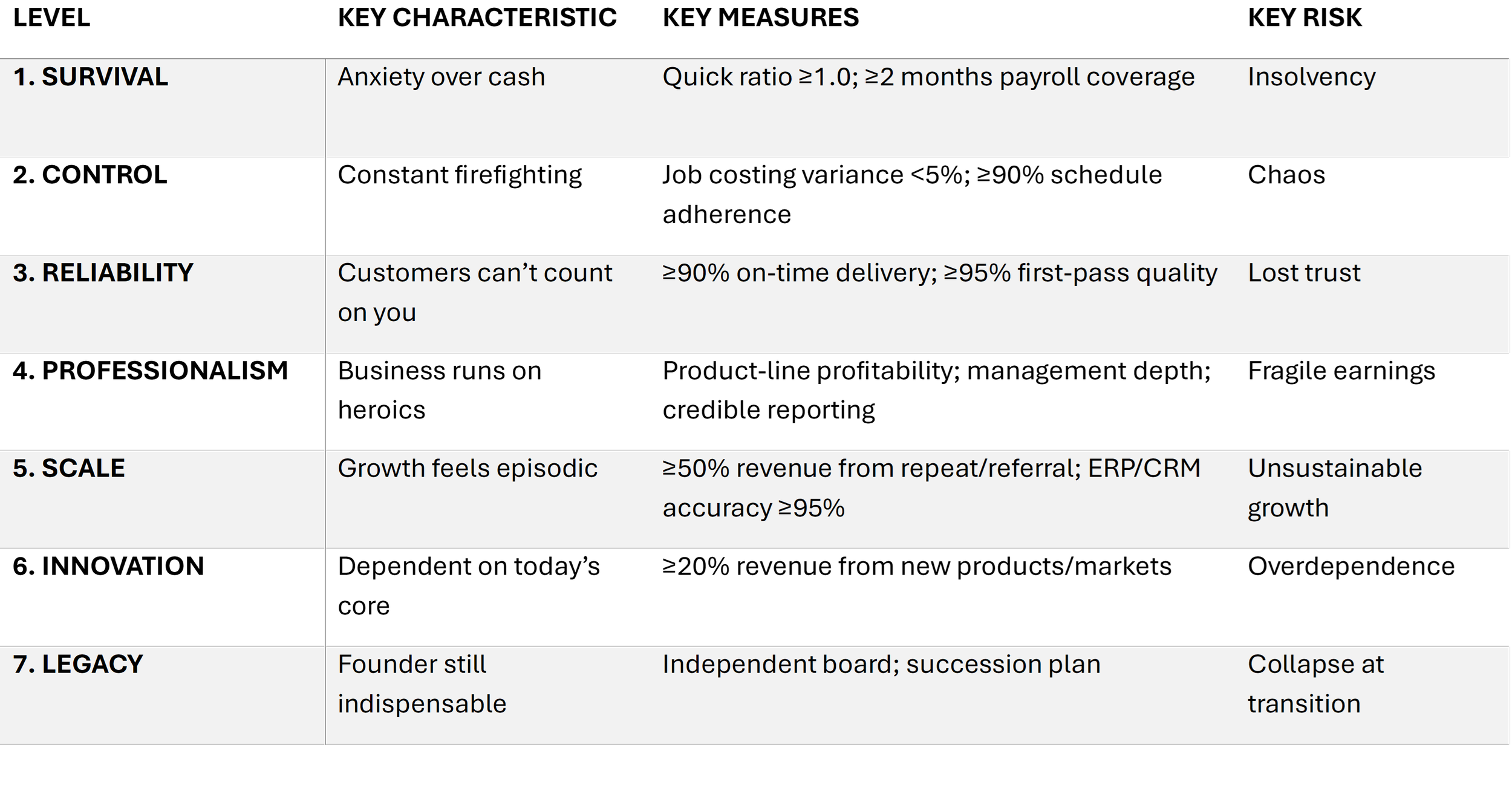

The Resilience Hierarchy: A Framework for Enduring Growth

The Resilience Hierarchy outlines five levels of business maturity—from liquidity to legacy—that predict whether growth endures or collapses.

Resilience is not grit; it is the deliberate design of systems that prevent reliance on heroics.

Resilience has become one of the most valuable yet elusive qualities in business. It is often confused with grit. Grit asks individuals to persevere through adversity by sheer willpower. Resilience, in contrast, is about designing systems so that endurance is not left to human stamina alone.

The distinction is visible in polar history. The crew of the Endurance, led by Ernest Shackleton, survived only by extraordinary grit after their ship was crushed by ice. By comparison, Fridtjof Nansen’s Fram was designed with a rounded hull that allowed it to ride above the pack ice rather than be destroyed by it. The crew still faced hardship, but they did not need superhuman endurance simply to survive. The difference was not in courage but in design.

Businesses face the same choice. They can rely on grit—leaders and employees working harder, longer, and under increasing strain—or they can build resilience into the enterprise itself. The Resilience Hierarchy offers a framework for doing the latter.

The model adapts the logic of Maslow’s hierarchy of needs to the realities of business growth. But unlike Maslow’s psychology, which aims for self-actualization, the Resilience Hierarchy is built as a constraint system, with future free cash flow as the objective function. Every for-profit enterprise has the same ultimate goal: to increase free cash flow. This delivers money to owners, lowers the cost of capital, and raises enterprise value. The hierarchy exists to help leaders identify and address the constraint most likely to limit those flows.

The hierarchy identifies seven levels of resilience: Survival, Control, Reliability, Professionalism, Scale, Innovation, and Legacy. Firms may move up or down in response to shocks or changing circumstances. What makes the framework powerful is its discipline. At any given time, a company faces only one true constraint. Addressing it unlocks progress. Ignoring it creates fragility.

Resilience is the essential bridge between today’s stable cash flows and tomorrow’s growth.

Global capital markets remain abundant, with investors and acquirers seeking reliable returns. Two qualities consistently attract capital: stable cash flows today and credible plans to grow those cash flows tomorrow. Resilience is the bridge between the two.

Each level of the hierarchy lays the infrastructure to ensure that progress is not easily reversed. Liquidity cushions shocks. Reliability builds customer trust. Professionalism creates credibility in reporting and leadership. Scale turns growth into momentum. Innovation reduces dependency on a single core. Governance secures continuity across generations of leaders.

Empirical research supports this logic. Liquidity shortages are the leading cause of small business failure. Supply chain studies show that reliability, especially on-time delivery, is the customer’s most important expectation. Research on management practices confirms that professionalized governance and financial discipline drive productivity and higher valuations. And innovation research highlights the importance of optionality and bold bets in sustaining long-term value.

Each level of the hierarchy has a single constraint that must be resolved before moving forward.

1. Survival. Liquidity is the constraint. Metrics such as the quick ratio, payroll coverage, and line-of-credit utilization determine readiness to progress. Growth without cash is simply deferred failure.

2. Control. Visibility is the constraint. Firms must establish accurate job costing, reliable scheduling, and trustworthy inventory data. Without control, leaders are forced to manage by intuition.

3. Reliability. Customer trust is the constraint. On-time delivery, first-pass quality, and equipment uptime determine whether the company can be depended upon.

4. Professionalism. Management depth and accountability are the constraint. Product-line profitability, value-based pricing, and distributed leadership are prerequisites for institutional credibility.

5. Scale. Flywheel friction is the constraint. When repeat and referral revenue exceed half of sales and core processes remain stable, growth compounds rather than stalls.

6. Innovation. Optionality is the constraint. Resilience requires a portfolio of credible opportunities and the discipline to act boldly when the right one emerges.

7. Legacy. Governance is the constraint. Without independent oversight and succession planning, even well-diversified firms remain fragile.

Progress requires crossing each threshold in order; skipping levels leaves the business fragile.

The hierarchy functions as a diagnostic system, rooted in the Theory of Constraints, with free cash flow as the objective.

The Resilience Hierarchy differs from many frameworks in its diagnostic orientation. It does not prescribe universal best practices. Instead, it provides a logic for identifying where a firm is constrained and what must be addressed next. Every business is unique in its products, people, and markets. Yet the sequence of constraints is universal.

This design is consistent with the Theory of Constraints. At any point, one binding limitation governs the system’s performance. In the Resilience Hierarchy, that system is the business, and the performance measure is the ability to generate and grow future free cash flows. The hierarchy guides leaders to focus on the constraint most likely to limit those flows. Once that constraint is resolved, the next emerges, and the cycle continues.

For leadership teams, the practical benefit is clarity. Rather than diluting attention across many initiatives, they can concentrate resources on the one factor that will most increase resilience and cash-generating capacity. This sequencing reduces wasted effort, prevents premature expansion, and ensures that progress compounds rather than regresses.

Lower middle market firms benefit most from a disciplined focus on cash flow as the universal measure of resilience.

The framework is particularly relevant for firms in the lower middle market. These businesses are often too complex to rely on intuition yet too resource-constrained to absorb repeated shocks. Many are also family- or founder-led, which magnifies the importance of succession and governance at later stages.

For owner-operators, the hierarchy provides a roadmap that links daily decisions to the ultimate goal: higher free cash flow. Improving cash flow not only increases the money available to owners, but also lowers the cost of capital by strengthening lender and investor confidence. In turn, this raises enterprise value.

For investors, the hierarchy offers a lens for evaluating resilience and identifying where targeted interventions will create the most value. It frames every operational or strategic improvement in terms of its contribution to sustainable cash flows.

Resilience frees organizations from relying on grit by ensuring systems, not people, carry the weight of endurance.

The Resilience Hierarchy is both pragmatic and rigorous. By identifying and addressing the binding constraint at each stage, companies can move forward with confidence. They can withstand shocks, adapt to change, and compound free cash flows over time.

Crucially, resilience reduces the need for constant grit. Just as the Fram’s design spared its crew from the ordeal faced by Shackleton’s men, a well-constructed business spares its people from relying on endless stamina and improvisation. Grit may save a company in crisis, but resilience ensures it rarely needs saving at all. In an era defined by volatility, that design choice is the difference between surviving on courage and thriving on cash flow.